The earliest forms of digital banking trace back to the advent of Atm machines and also cards released in the 1960s. As the web arised in the 1980s with early broadband, electronic networks started to connect retailers with distributors as well as customers to establish needs for very early on the internet catalogues and inventory software application systems.

The enhancement of broadband and ecommerce systems in the early 2000s caused what looked like the modern-day electronic financial world today. The proliferation of smartphones through the following decade unlocked for deals on the move past ATM MACHINE equipments. Over 60% of consumers now utilize their smart devices as the recommended approach for electronic financial.

This dynamic forms the basis of consumer fulfillment, which can be nurtured with Consumer Connection Monitoring (CRM) software application. For that reason, CRM must be integrated right into an electronic financial system, because it supplies methods for financial institutions to directly communicate with their clients. There is a demand for end-to-end consistency and also for services, enhanced on ease as well as customer experience.

In order for financial institutions to fulfill customer demands, they need to keep focusing on improving electronic technology that supplies agility, scalability as well as effectiveness. A research conducted in 2015 disclosed that 47% of lenders see prospective to boost consumer relationship via electronic financial, 44% see it as a method to create competitive advantage, 32% as a network for new client purchase.

Major advantages of digital banking are: Business performance - Not only do electronic systems boost communication with customers and also supply their demands extra promptly, they additionally give methods for making inner features a lot more reliable. While financial institutions have actually gone to the center of electronic innovation at the consumer end for years, they have not completely accepted all the benefits of middleware to increase efficiency.

Conventional financial institution handling is pricey, slow and prone to human error, according to McKinsey & Firm. Relying upon people as well as paper likewise takes up workplace area, which adds power and also storage prices. Digital systems can future lower costs through the synergies of more qualitative information and faster feedback to market adjustments.

Combined with absence of IT integration between branch and back workplace employees, this issue decreases organization effectiveness. By streamlining the confirmation process, it's easier to implement IT remedies with service software application, resulting in more exact accounting. Financial precision is vital for banks to comply with federal government regulations. Improved competitiveness - Digital solutions help take care of advertising lists, enabling banks to get to broader markets and develop closer connections with technology savvy consumers.

It works for performing client rewards programs that can boost loyalty and also contentment. Greater dexterity - Using automation can quicken both outside as well as inner processes, both of which can enhance customer fulfillment. Complying with the collapse of financial markets in 2008, a boosted focus was put on threat management.

Enhanced safety and security - All companies big or little face an expanding number of cyber threats that can harm track records. In February 2016 the Irs revealed it had been hacked the previous year, as did numerous huge tech business. Banks can benefit from extra layers of security to safeguard information.

By changing hand-operated back-office procedures with automated software solutions, banks can reduce employee errors as well as speed up processes. This standard shift can result in smaller sized operational systems as well as enable supervisors to focus on enhancing tasks that require human treatment. Automation minimizes the demand for paper, which certainly ends up occupying room that can be occupied with innovation.

One means a bank can enhance its back end company effectiveness is to divide thousands of procedures into three categories: complete computerized partially automated hands-on jobs It still isn't sensible to automate all procedures for several economic companies, specifically those that perform financial evaluations or offer financial investment guidance. Yet the even more a financial institution can replace difficult repetitive guidebook jobs with automation, the a lot more it can concentrate on concerns that include straight communication with customers.

Furthermore, electronic cash money can be mapped as well as made up extra accurately in cases of disagreements. As consumers discover a raising variety of acquiring opportunities at their fingertips, there is much less requirement to lug physical cash money in their wallets. Other indications that demand for electronic cash money is expanding are highlighted by the use of peer-to-peer repayment systems such as PayPal and also the surge of untraceable cryptocurrencies such as bitcoin.

The issue is this modern technology is still not universal. Cash blood circulation expanded in the United States by 42% in between 2007 and also 2012, with an ordinary annual development price of 7%, according to the BBC. The concept of an all electronic cash economy is no more just a futuristic desire but it's still not likely to obsolete physical money in the close to future.

ATMs help banks cut above, especially if they are readily available at various critical areas past branch workplaces. Emerging types of digital financial are These services improve enhanced technical styles along with different service designs. The choice for financial institutions to include more digital solutions at all operational degrees will certainly have a significant effect on their economic security.

Sharma, Gaurav. " What is Digital Banking?". VentureSkies. Obtained 1 May 2017. Kelman, James (2016 ). The Background of Banking: A Detailed Reference Source & Guide. CreateSpace Independent Posting Platform. ISBN 978-1523248926. Locke, Clayton. " The tempting rise of electronic banking". Banking Technology. Fetched 9 May 2017. Ginovsky, John. " What actually is "electronic banking"? Consensus on this oft-used term's significance avoids".

Recovered 9 May 2017. Dias, Joao; Patnaik, Debasish; Scopa, Enrico; van Bommel, Edwin. " Automating the bank's back office". McKinsey & Firm. Gotten 9 May 2017. Eveleth, Rose. " Will cash go away? Several innovation supporters believe so, but as Rose Eveleth finds, the reality is extra difficult". BBC. Obtained 9 May 2017.

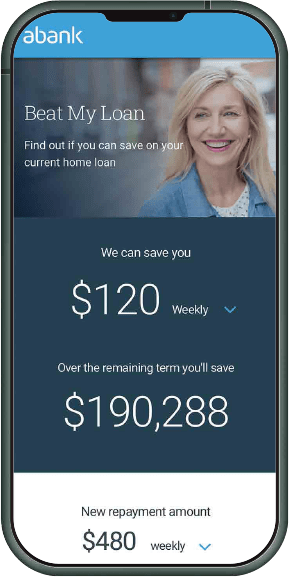

Our cloud based service integrates sector leading safety, reducing your costs and providing you satisfaction. This solitary platform promotes natural development through our vast library of open APIs, feature rich capability and also considerable reporting abilities.

You can find more information about the topic here: adelaide banking

Sandstone Technology Group

Level 4/123 Walker St,

North Sydney NSW 2060, Australia

+61299117100

https://www.sandstone.com.au/en-au/

Postal Address:

PO Box 2011, North Sydney

NSW 2059 AUSTRALIA